Certificate Management is a feature of Royal Credit Union’s mobile app and online banking that lets you manage your certificate and Lock & Earn accounts. You can use Certificate Management to:

- Change what happens to a personal certificate at maturity - either automatic renewal or close and deposit funds to another account

- Close a certificate early and pay any penalties that apply

- Add or remove funds to or from your certificate or Lock & Earn account while it’s in the grace period

- Change the account name to help keep track of different certificates

- Members with personal certificate accounts can also select a new certificate term during the grace period if desired

Businesses can also manage business certificates with this feature, although only some of the options are available. Businesses aren't able to close a certificate early or add or remove funds at maturity.

Certificate Management is only available for standard certificates and Lock & Earn accounts; IRA and HSA certificates aren’t eligible to be managed with this feature.

Accessing Certificate Management

In Royal’s personal online banking system on the web, log in and open the Manage Money menu. Then select Certificate Management.

Or, in the personal experience of Royal’s mobile app, log in and go to the More menu. Then, tap the Services section and select the Certificate Management feature.

You’ll see a listing of all the certificates and Lock & Earn accounts you can manage. Select an account to see more options.

You can also use the link below to jump directly to the Certificate Management feature after you log in:

Businesses can access Certificate Management through similar menus in the business experience of our mobile app and online banking.

Managing Your Certificate

See Certificate Info

See Certificate Info

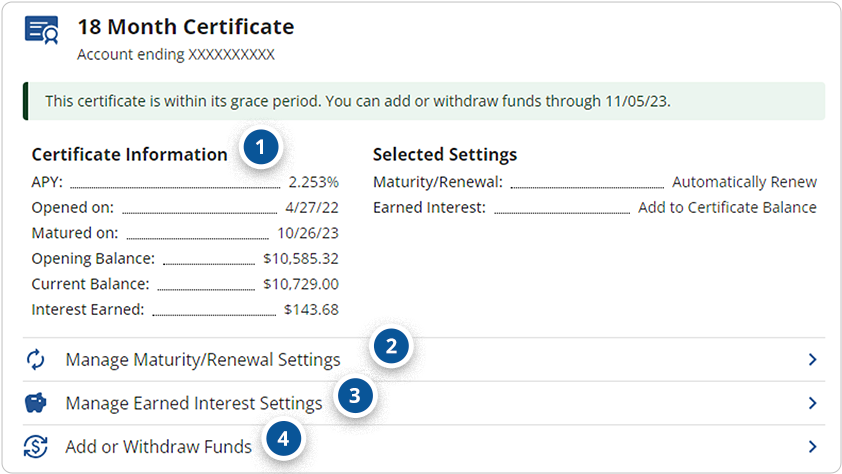

When you select a certificate, you can see detailed information about it, including the current amount of interest earned, the maturity date, and the current maturity renewal instructions.

Manage Maturity Settings

Manage Maturity Settings

You can change the certificate maturity instructions. By default, Royal certificates automatically renew when the certificate term ends. You can request that the certificate be closed instead.

Manage Earned Interest

Manage Earned Interest

You can change how the certificate’s earned interest is handled. Most certificates default to compounding earned interest back to the certificate account, but you can elect to have earned interest transferred to another Royal account monthly.

Add Or Withdraw Funds During Grace Period

Add Or Withdraw Funds During Grace Period

During the certificate’s grace period, you can add or withdraw funds. The grace period is a ten-day period starting on the certificate’s maturity date. During the grace period, you can withdraw funds from the certificate and deposit them into another Royal account (up to the full amount of the certificate, which will close the account) or add funds to the certificate from another Royal account. Members with personal certificate accounts can also choose to change the term of the certificate during the grace period. For example, they could select a new 12-month certificate term instead of the original 9-month term. You can also withdraw funds before maturity and pay any penalty that applies.

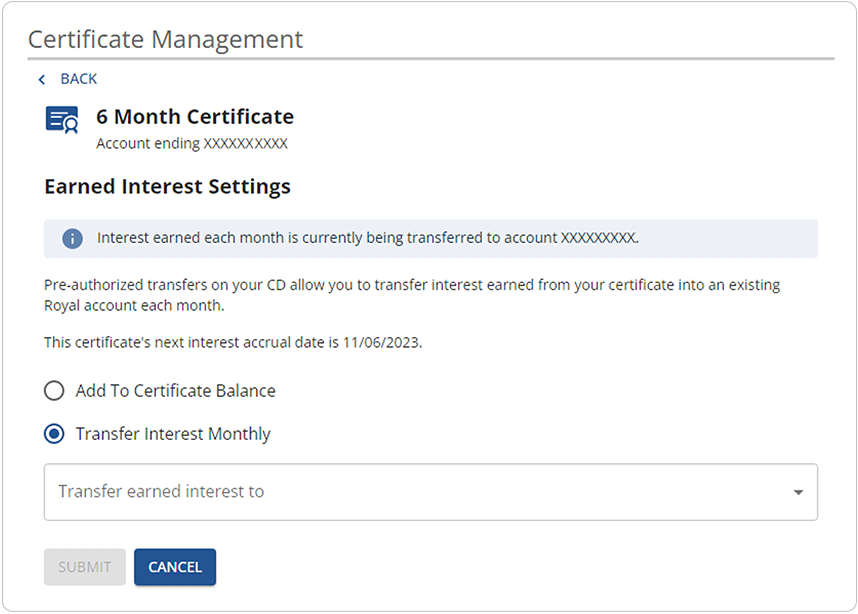

Managing Earned Interest

Most certificates default to compounding earned interest back to the certificate account. You can elect to have earned interest transferred to another Royal account monthly. If you make this election, your change will take effect on the next interest accrual date shown in the screen below.

Take the Next Step

Like this article?

Sign up to get more articles by email.

Need help?

Schedule an office appointment.

Not a Member?

Open your account today.