Changing your statement delivery preferences to electronic statements is easy - and it provides several security and convenience benefits.

- Faster delivery. Electronic statements are typically available on the first day of each month. No more waiting for the mail!

- Reduced fraud risk. Electronic statements ensure that personal and account information is securely stored in online banking. You don't need to worry about mail theft or lost mail!

- Keeps you organized. Statement files are organized by date. You can easily print or save your statements in PDF format. Most accounts will show up to three years of statement history, and Royal can provide up to seven years upon request.

How Do I Opt In To Paperless Statements?

For Royal savings, checking, and loan accounts:

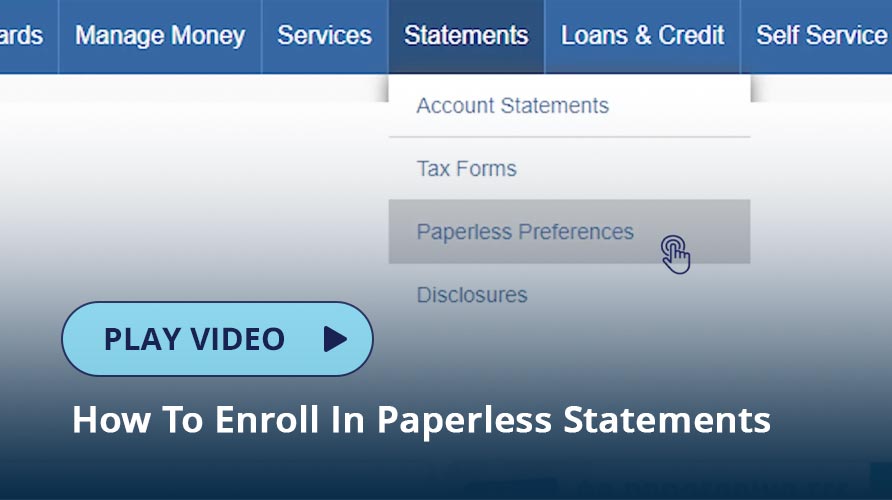

- In online banking, choose Statements from the top menu and then select Paperless Preferences. Or, in the mobile app, choose More, then open the Statements section if needed, then choose Paperless Preferences.

- Toggle the paperless switches for the accounts that you want to enroll in electronic statements (this is probably all accounts listed)!

- If you would like to receive tax documents electronically, also toggle the switch for Tax Statement Delivery. Your preferences will be saved automatically.

For Royal personal credit cards:

- From the Cards menu of online banking or our mobile app, select the Credit Card Access option, then select the Statements menu item.

- Then, toggle the switch for Paperless Statements to the on position and complete the setup in the popup menu.

For Royal business credit cards, please contact us.

For all accounts, you may return to paper statements at any time by updating the above preferences.

Where Are My Electronic Statements?

Once you enroll in electronic statements for Royal savings, checking, and loan accounts, you can access them from the Account Statements option under the Statements menu in online banking or the mobile app. Just click or tap on the account name to open a PDF version of your statement. Statements are combined to show multiple accounts on a single statement. You can review which accounts are combined on the Paperless Preferences option under the Statements menu.

For Royal personal credit cards, choose the Credit Card Access option on the Cards menu of online banking or our mobile app. On the credit card screen, select the Statements menu item, and then download the PDF for the statement you want to view.

When Will I Receive My Statement?

Electronic statements are typically available in online banking or the mobile app on the first of the month. Paper statements are mailed by the fifth business day of the month. We encourage everyone to switch to electronic statements to get access to their statement faster.

Where Are My Checking Account Statements?

Checking account statements can be found within the statements for your Primary Base Savings account. In online banking or our mobile app, choose your Primary Base Savings account statement to see your checking account statement information.

Where Is My Tax Information?

For help finding your year-end tax information, please see our Tax Documents article.

Take the Next Step

Like this article?

Sign up to get more articles by email.

Need help?

Schedule an office appointment.

Not a Member?

Open your account today.